Trading the Shark Pattern — The Full Guide.

Presenting and Trading the Shark Harmonic Pattern.

Harmonic Patterns are one of the powerful advanced price action techniques that are used to detect reactions. The thing that works about Harmonic Patterns is that they use the confluence method, meaning that they expect reactions from clusters of certain levels defined by Fibonacci retracements.

The reason they work has nothing to do with mystic or magic whatsoever, it is simply the fact that Fibonacci retracements are used by many traders and their visibility makes reactions more likely, thus increasing the predictive power of the patterns. However, only using Harmonic Patterns on their own might not be sufficient as we will see below, they are best combined with contrarian indicators to increase the chances of a profitable trade.

I have just released a new book after the success of my previous one “The Book of Trading Strategies”. It features advanced trend-following indicators and strategies with a GitHub page dedicated to the continuously updated code. Also, this book features the original colors after having optimized for printing costs. If you feel that this interests you, feel free to visit the below Amazon link, or if you prefer to buy the PDF version, you could contact me on LinkedIn.

Introduction to the Fibonacci Sequence

Leonardo Bonacci, known as Leonardo Fibonacci has developed a sequence out of rabbit mating which formed the basis for many mathematical observations. The sequence follows this distinct pattern:

The numbers are found by adding the previous two numbers behind them. In the case of 13, it is calculated as 8 + 5, hence the formula is:

The beauty of these numbers is a certain ratio, called the golden ratio. If we take any two successive numbers in the sequence, their ratio (Xn / Xn-1) gets closer to 1.618 which is what we call the golden ratio:

It is not important how we got to trading from these patterns as much as how important they are, therefore, we will discuss the ratios from a financial trading perspective. Let us keep the 1.618 in mind as for the moment it is one of the two most important ratios that we will use in trading. Our job now is to find the rest of the significant ratios useful to us in trading. They are all variations of 1.618 and its reciprocal 0.618. Notice how the reciprocal of 1.618 is simply 0.618. A reciprocal is when you divide 1 by the number. The below table summarizes the rest of the ratios and how we got them:

We will now proceed to define the Pattern and how to detect and trade it.

The Shark Pattern

The Shark pattern is a configuration that takes advantage of extended moves to detect an imminent reversal level. It is defined as:

A retracement of 113.0% — 161.8% before reversing to the other side.

The retracement of the reversal should be 161.8% and 113.0% from the beginning of the pattern as shown below.

The figure above shows a nice reaction after prices reached 161.8%. The Shark pattern benefits from the time factor as extended moves are bound to correct sometimes. It is not that easy to detect nor is it common but when it occurs, it definitely adds value to our trading.

It becomes clear that a bullish Shark resembles an M while a bearish Shark resembles a W. We expect a form of reaction around the D point. The pattern is always composed of five points in time XABCD where we trade the last point and manage our risk according to specific measures discussed in the last part of the article.

Detecting the Shark Pattern

The Shark Pattern can start to be detected around mid-way between point C and point D where the market price breaks (or surpassed) the low (or high) of the B point. Therefore, we have enough time to act on it without any hindsight bias or delay. The below plots show how to detect one across time:

The first step above is simply detecting an impulse move following by a reactionary move that should retrace back to 113.0%. After that, we have to wait whether the reaction will retrace back again to 161.8% of the new leg or not. This means that the BC leg must retrace 161.8% while the XC leg must retrace 113.0%, and this is where the D point is situated. Remember, the D point is the reversal point.

Having reached close to the D point, the pattern becomes clear and should show clearly the reversal level as outlined in the chart above.

Now, we can even draw the Shark. All we need is the expected reaction from the D point defined as the 161.8% retracement from the BC leg as well as the 113.0% retracement of the XC move. This means that the length of the CD leg must equal 1.618x the length of the BC leg. And finally, we should manage the reaction according to the risk management measures outlined in the last part of the article.

Combining the Shark with the RSI

Having a Shark Pattern at its D point (pending reaction) and an RSI around extremes or in divergence is a good confirmation of the trade and is a conviction enhancer. But what is the Relative Strength Index?

The RSI is without a doubt the most famous momentum indicator out there, and this is to be expected as it has many strengths especially in ranging markets. It is also bounded between 0 and 100 which makes it easier to interpret. Also, the fact that it is famous, contributes to its potential.

This is because the more traders and portfolio managers look at the RSI, the more people will react based on its signals and this, in turn, can push market prices. Of course, we cannot prove this idea, but it is intuitive as one of the basis of Technical Analysis is that it is self-fulfilling.

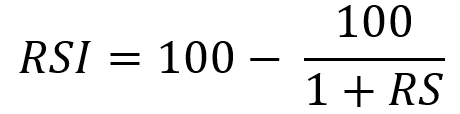

The RSI is calculated using a rather simple way. We first start by taking price differences of one period. This means that we have to subtract every closing price from the one before it. Then, we will calculate the smoothed average of the positive differences and divide it by the smoothed average of the negative differences. The last calculation gives us the Relative Strength which is then used in the RSI formula to be transformed into a measure between 0 and 100.

Risk Management on the Shark Pattern

Trading on the patterns requires touching the implied reversal zone, also referred to as Potential Reversal Zone — PRZ. A basic rule of thumb that we can follow when trading is to place two targets with the first one being at 38.2% of the top to bottom (or bottom to top) retracement and the second one being at 61.8%. The stop will be placed at half the distance between the entry and the second target thus ensuring a 2.0 risk-reward ratio. I generally take half the profits at the first target and move the stop to breakeven, that way I ensure that the trade never loses money in case the price comes back unfavorably. Below is an example of the simples of Harmonic Patterns, the ABCD pattern showing clear risk management.

Conclusion

Contrarian trading using price action and indicators is a powerful tool to profit from intermediate market reactions. As is known, no strategy is perfect but with proper risk management, a good strategy will last long and provide the expected outcome. We need to always be aware of any fundamentals when trading the patterns on the higher time frame like Weekly charts as we all know, fundamentals are what push prices over the long-term horizon. Also, in the short-term, we need to be always aware of any expected news of economic releases that may induce short-term noise. Technical Analysis does not work when everyone is panicking or hopping on euphoria. It is a tool for normality combined with a slightly statistical extreme.