Harmonic Patterns are one of the powerful advanced price action techniques that are used to detect reactions. The thing that works about Harmonic Patterns is that they use the confluence method, meaning that they expect reactions from clusters of certain levels defined by Fibonacci retracements.

The reason they work has nothing to do with mystic or magic whatsoever, it is simply the fact that Fibonacci retracements are used by many traders and their visibility makes reactions more likely, thus increasing the predictive power of the patterns. However, only using Harmonic Patterns on their own might not be sufficient as we will see below, they are best combined with contrarian indicators to increase the chances of a profitable trade.

Introduction to the Fibonacci Sequence

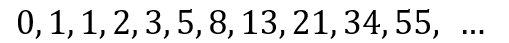

Leonardo Bonacci, known as Leonardo Fibonacci has developed a sequence out of rabbit mating which formed the basis for many mathematical observations. The sequence follows this distinct pattern:

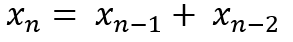

The numbers are found by adding the previous two numbers behind them. In the case of 13, it is calculated as 8 + 5, hence the formula is:

The beauty of these numbers is a certain ratio, called the golden ratio. If we take any two successive numbers in the sequence, their ratio (Xn / Xn-1) gets closer to 1.618 which is what we call the golden ratio:

It is not important how we got to trading from these patterns as much as how important they are, therefore, we will discuss the ratios from a financial trading perspective. Let us keep the 1.618 in mind as for the moment it is one of the two most important ratios that we will use in trading. Our job now is to find the rest of the significant ratios useful to us in trading. They are all variations of 1.618 and its reciprocal 0.618. Notice how the reciprocal of 1.618 is simply 0.618. A reciprocal is when you divide 1 by the number. The below table summarizes the rest of the ratios and how we got them:

We will now proceed to define the Pattern and how to detect and trade it.

You can also check out my other newsletter The Weekly Market Sentiment Report that sends tactical directional views every weekend to highlight the important trading opportunities using a mix between sentiment analysis (COT reports, Put-Call ratio, Gamma exposure index, etc.) and technical analysis.

The Harmonic 5–0 Pattern

The 5–0 pattern is an interesting configuration that is a continuation of the Extreme Harmonic Impulse Wave pattern seen in a previous article where the link is provided below. It is defined as:

The first leg should retrace back either 113.0% or 161.8%.

The second leg should retrace back either 161.8% or 224.0%.

The third leg should retrace back 50.0%. In case the retracement fails, the next retracement lies at 88.6% from where a reaction should be seen.

The figure above shows the 5–0 pattern as a resistance around the 50.0% retracement from the tops of the Extreme Harmonic Impulse Wave pattern.

Detecting the 5–0 Pattern

The 5–0 Pattern can start to be detected around the time we see the reaction from the Harmonic Extreme Impulse Wave pattern as seen in the below chart. The moment we react from the 161.8% of 224.0%, we have to start monitoring the full retracement from the top (if it is a bearish 5–0 pattern) or from the bottom (if it is a bullish 5–0 pattern).

It is worth-mentioning that the two patterns provide the opposite signal to one another, which is a very useful thing because it allows us to take the profits when the second pattern is validated. This means that when it comes to risk management, the theoretical profit on the Extreme Harmonic Impulse Wave should be 50.00%, assuming we never reach 88.6% retracement.

The above plot is easy to explain. Basically, after having reacted from the first pattern, we need to target 50.0% of the whole top-to-bottom retracement before we take the profit on the long position and start shorting.

The below plot shows a mini 5–0 pattern in the giant 5–0 pattern we have seen above. Notice that as always, it is composed of a mini Extreme Harmonic Impulse Wave followed by a projected retracement on the 50.0% level, only this time, the first support at 50.0% (of the mini pattern) has failed, but we have perfectly reversed from the second one at 88.6%.

And finally, we should manage the reaction according to the risk management measures outlined in the last part of the article.

Combining the Harmonic 5–0 with the RSI

Having a 5–0 Pattern at its potential reversal level (or zone) and an RSI around extremes or in divergence is a good confirmation of the trade and is a conviction enhancer. But what is the Relative Strength Index?

The RSI is without a doubt the most famous momentum indicator out there, and this is to be expected as it has many strengths especially in ranging markets. It is also bounded between 0 and 100 which makes it easier to interpret. Also, the fact that it is famous, contributes to its potential.

This is because the more traders and portfolio managers look at the RSI, the more people will react based on its signals and this in turn can push market prices. Of course, we cannot prove this idea, but it is intuitive as one of the basis of Technical Analysis is that it is self-fulfilling.

The RSI is calculated using a rather simple way. We first start by taking price differences of one period. This means that we have to subtract every closing price from the one before it. Then, we will calculate the smoothed average of the positive differences and divide it by the smoothed average of the negative differences. The last calculation gives us the Relative Strength which is then used in the RSI formula to be transformed into a measure between 0 and 100.

Risk Management on the Harmonic 5–0 Pattern

Trading on the patterns requires touching the implied reversal zone, also referred to as Potential Reversal Zone — PRZ. A basic tule of thumb that we can follow when trading is to place two targets with the first one being at 50.0% of the top to bottom (or bottom to top) retracement and the second one being at 88.6%. The stop will be placed at half the distance between the entry and the second target thus ensuring a 2.0 risk reward ratio. I generally take half the profits at the first target and move the stop to breakeven, that way I ensure that the trade never loses money in case the price comes back unfavorably. Below is an example on the simples of Harmonic Patterns, the ABCD pattern showing clear risk management.

You can also check out my other newsletter The Weekly Market Analysis Report that sends tactical directional views every weekend to highlight the important trading opportunities using technical analysis that stem from modern indicators. The newsletter is free.

If you liked this article, do not hesitate to like and comment, to further the discussion!