This rare gem is a trend-following indicator that can be used either as a trading system or as a way to place your stops. We will introduce the intuition of the SuperTrend indicator. Of course, just like any other indicator, the SuperTrend can find its place within a bigger trading system but not take over the whole decision-making process.

Building Blocks

The first concept we should understand before creating the SuperTrend indicator is volatility. We sometimes measure volatility using the average true range (ATR). Although the ATR is considered a lagging indicator, it gives some insights as to where volatility is right now and where has it been last period (day, week, month, etc.). But before that, we should understand how the True Range is calculated (the ATR is just the average of that calculation).

The true range is simply the greatest of the three price differences:

High - Low

| High - Previous close |

| Previous close - Low |

Once we have got the maximum out of the above three, we simply take an average of n periods of the true ranges to get the ATR. Generally, since in periods of panic and price depreciation we see volatility go up, the ATR will most likely trend higher during these periods, similarly in times of steady uptrends or downtrends, the ATR will tend to go lower. One should always remember that this indicator is very lagging and therefore has to be used with extreme caution.

Check out my newsletter that sends weekly directional views every weekend to highlight the important trading opportunities using a mix between sentiment analysis (COT report, put-call ratio, etc.) and rules-based technical analysis.

The SuperTrend Indicator

The SuperTrend indicator is a popular technical analysis tool that identifies the direction of a trend and generates buy or sell signals based on price movements. It's a trend-following indicator that works well in trending markets but may give false signals in choppy markets. It consists of a line plotted on the price chart, which changes color and position based on the trend direction.

The Supertrend is based on two parameters:

ATR: Measures market volatility.

Multiplier: A user-defined value that determines the sensitivity of the indicator.

The calculation involves:

Upper Band:

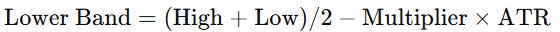

Lower Band:

Supertrend Line:

If the price closes above the upper band, the Supertrend switches below the price and acts as a support line.

If the price closes below the lower band, the Supertrend switches above the price and acts as a resistance line.

You can find the indicator pre-built in Tradingview.

Here are some best practices:

Use the Supertrend in combination with other indicators to confirm signals.

Avoid relying on it solely in range-bound or choppy markets.

Regularly backtest and optimize the parameters for your specific trading strategy.

Conclusion

We have seen together this powerful indicator and learnt how to code it and now it is time to evaluate it. Broadly speaking, it looks acceptable on some pairs and much more optimization can be done with the addition of other indicators and techniques. Also, the risk management method used in the back-test was very basic and more complicated techniques can be used. My personal experience is that this indicator shows some potential and can be improved.