The Gamma Exposure Trading Strategy

Creating a Strategy on the S&P500 Using the Gamma Exposure in Python

Sentiment Analysis is a vast and promising field in data analytics and trading. It is a rapidly rising type of analysis that uses the current pulse and market feeling to detect what participants intend to do or what positions they are holding.

Imagine you are planning to go see a movie and you want to anticipate whether this movie will be good or not, therefore, you ask many of your friends — whom have already seen the movie — about their opinions. Assuming 75% said the movie was good, you will have a certain confidence level that you will like it because the sentiment around this movie was mostly good (ignoring tastes and preferences). The same analogy can be applied to the financial markets through many ways either quantitative or qualitative.

Sometimes, indicators will be classified as more than one type, meaning a technical indicator can also be a sentiment indicator (e.g. the On-Balance Volume). And the way we analyze can also be technical (e.g. drawing support and resistance lines) or quantitative (e.g. mean-reversion).

This article will discuss an index called the Gamma Exposure and how is it used to predict the direction of the S&P500. For this study, we will use the signal quality as a judge.

I have released a new book after the success of my previous one “Trend Following Strategies in Python”. It features advanced contrarian indicators and strategies with a GitHub page dedicated to the continuously updated code. If you feel that this interests you, feel free to visit the below Amazon link (which contains a sample), or if you prefer to buy the PDF version, you could check the link at the end of the article.

Contrarian Trading Strategies in Python

Amazon.com: Contrarian Trading Strategies in Python: 9798434008075: Kaabar, Sofien: Bookswww.amazon.com

Introduction to Sentiment Analysis

Sentiment Analysis is a type of predictive analytics that deal with alternative data other than the basic OHLC price structure. It is usually based on subjective polls and scores but can also be based on more quantitative measures such as expected hedges through market strength or weakness. One known objective sentiment analysis indicator is the Commitment of Traders report.

This article will deal with an indicator called the Gamma Exposure Index, a sophisticated time series provided by squeezemetrics on a daily basis. The data itself harbors extremely valuable information when it comes to equity indices and trading. We will see how to download historical data on the S&P500 automatically in Python as well as the Gamma Exposure Index, then we will design a trading strategy and evaluate it through the signal quality metric.

The Gamma Exposure Index

The Gamma Exposure Index also known as the GEX, relates to the sensitivity of option contracts to changes in the underlying price. When imbalances occur, the effects of market makers’ hedges may cause price swings (such as short squeezes). The absolute value of the GEX index is simply the number of shares that will be bought or sold to push the price in the opposite direction of the trend when a 1% absolute move occurs. For example, if the price moves +1% with the GEX at 5.0 million, then, 5.0 million shares will come pouring in to push the market to the downside as a hedge.

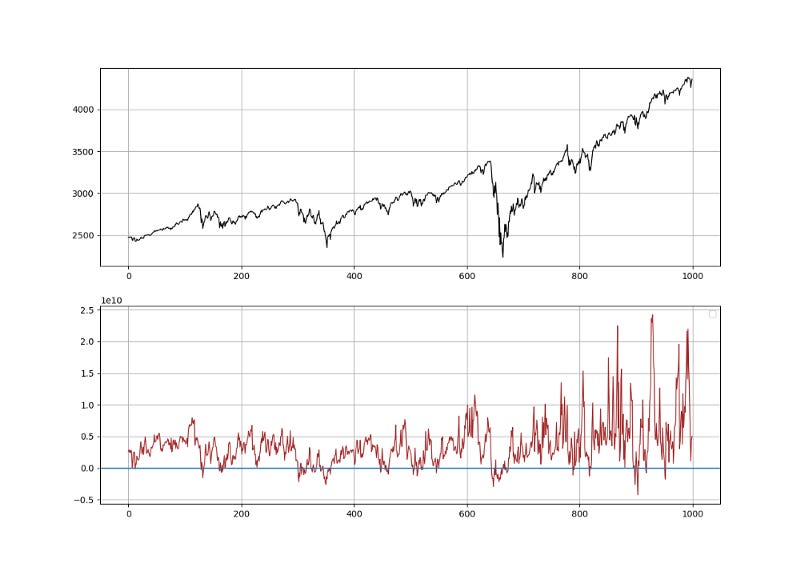

As documented, the GEX acts as a brake on prices when it is high enough with a rising market and as an accelerator when it is low enough. The below graph shows the values of the S&P500 charted along the values of the Gamma Exposure Index.

If you are also interested by more technical indicators and strategies, then my book might interest you:

The Book of Trading Strategies

Amazon.com: The Book of Trading Strategies: 9798532885707: Kaabar, Sofien: Bookswww.amazon.com

Downloading the Data & Designing the Strategy

We will use Python to download automatically the data from the website. We will be using a library called selenium, famous for fetching and downloading data online. The first thing we need to do is to define the necessary libraries.

# Importing Libraries

import pandas as pd

import numpy as np

from selenium import webdriverWe will assume that we will be using Google Chrome for this task, however, selenium supports other web browsers so if you are using another web browser, the below code will work but will need to change for the name of your browser, e.g. FireFox.

# Calling Chrome

driver = webdriver.Chrome('C:\user\your_file/chromedriver.exe')# URL of the Website from Where to Download the Data

url = "https://squeezemetrics.com/monitor/dix"

# Opening the website

driver.get(url)

# Getting the button by ID

button = driver.find_element_by_id("fileRequest")To understand what we are trying to do, we can think of this as an assistant that will open a Google Chrome window, type the address given, searches for the download button until it is found. The download will include the historical data of the S&P500 as well as the Gamma Exposure Index and another time series that we will discuss in a later article. For now, the focus is on the GEX.

All that is left now is to simply click the download button which is done using the following code:

# Clicking on the button

button.click()You should see a completed download called DIX in the form of a csv excel file. It is time to import the historical data file to the Python interpreter and structure it the way we want it to be. Make sure the path of the interpreter is in the downloads section where the new DIX file is found.

We will use pandas to read the csv file, then numpy to transform it into an array and shape it. Before we do this, let us first define two needed primal manipulation functions:

# A Function to Add a Specified Number of Columns

def adder(Data, times):

for i in range(1, times + 1):

new = np.zeros((len(Data), 1), dtype = float)

Data = np.append(Data, new, axis = 1) return Data# A Function to Delete a Specified Number of Columns

def deleter(Data, index, times):

for i in range(1, times + 1):

Data = np.delete(Data, index, axis = 1)return DataNext, we can use the following syntax to organize and clean the data. Remember, we have a csv file composed of three columns, the S&P500, an unknown time series that we will discuss in a later article, and the GEX which we will use to time the market.

# Importing the Excel File Using pandas

my_data = pd.read_csv('DIX.csv')# Transforming the File to an Array

my_data = np.array(my_data)# Eliminating the time stamp

my_data = my_data[:, 1:4]# Deleting the Middle Column

my_data = deleter(my_data, 1, 1)Right about now, we should have a clean 2-column array with the S&P500 and the Gamma Exposure Index. Let us write the conditions for the trade following the intuition we have seen in the GEX section:

A bullish signal is generated if the GEX reaches or breaks the zero level while the previous three GEX readings are above zero so that we eliminate duplicates.

No bearish signal is generated so that we harness the GEX’s power in an upward sloping market. The reason we are doing this is that we want to build a trend-following system. However, it may also be interesting to try and find bearish signals on the GEX. For simplicity, we want to see how well it times the market using only long signals.

# Creating the Signal Function

def signal(Data, gex, buy):

Data = adder(Data, 1)

for i in range(len(Data)):

if Data[i, gex] <= 0 and Data[i - 1, gex] > 1 and Data[i - 2, gex] > 1 and Data[i - 3, gex] > 1:

Data[i, buy] = 1

return Datamy_data = signal(my_data, 1, 2)

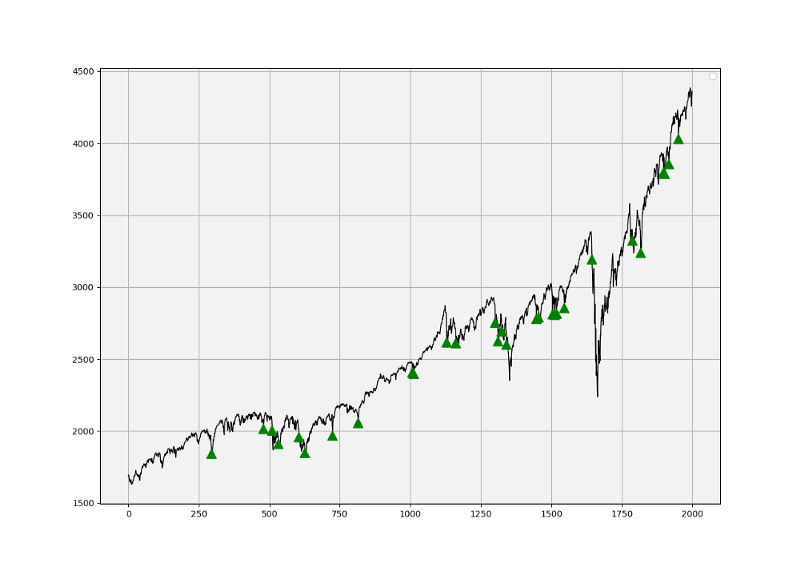

The code above gives us the signals shown in the chat. We can see that they are of good quality and typically the false signals occur only on times of severe volatility and market-related issues. As a buying-the-dips timing indicator, the GEX may be promising. Let us evaluate this using one metric for simplicity, the signal quality.

The signal quality is a metric that resembles a fixed holding period strategy. It is simply the reaction of the market after a specified time period following the signal. Generally, when trading, we tend to use a variable period where we open the positions and close out when we get a signal on the other direction or when we get stopped out (either positively or negatively). Sometimes, we close out at random time periods. Therefore, the signal quality is a very simple measure that assumes a fixed holding period and then checks the market level at that time point to compare it with the entry level. In other words, it measures market timing by checking the reaction of the market.

def signal_quality(Data, spx, signal, period, result):

Data = adder(Data, 1)

for i in range(len(Data)):

if Data[i, signal] == 1:

Data[i + period, result] = Data[i + period, spx] - Data[i, spx] return Data# Using 21 Periods as a Window of signal Quality Check

my_data = signal_quality(my_data, 0, 2, 21, 3)positives = my_data[my_data[:, 3] > 0]

negatives = my_data[my_data[:, 3] < 0]# Calculating Signal Quality

signal_quality = len(positives) / (len(negatives) + len(positives))print('Signal Quality = ', round(signal_quality * 100, 2), '%')# Output: 74.36 %A signal quality of 74.36% means that on 100 trades, we tend to see in 74 of the cases a higher price 21 periods after getting the signal. The signal frequency may need to be addressed as there were not much signals since 2011 (~ 39 trades). Of course, perfection is the rarest word in finance and this technique can sometimes give false signals as any strategy can.

Remember to always do your back-tests. You should always believe that other people are wrong. My indicators and style of trading may work for me but maybe not for you.

I am a firm believer of not spoon-feeding. I have learnt by doing and not by copying. You should get the idea, the function, the intuition, the conditions of the strategy, and then elaborate (an even better) one yourself so that you back-test and improve it before deciding to take it live or to eliminate it. My choice of not providing specific Back-testing results should lead the reader to explore more herself the strategy and work on it more.

Summary

To summarize up, what I am trying to do is to simply contribute to the world of objective technical analysis which is promoting more transparent techniques and strategies that need to be back-tested before being implemented. This way, technical analysis will get rid of the bad reputation of being a subjective and scientifically unfounded.

I recommend you always follow the the below steps whenever you come across a trading technique or strategy:

Have a critical mindset and get rid of any emotions.

Back-test it using real life simulation and conditions.

If you find potential, try optimizing it and running a forward test.

Always include transaction costs and any slippage simulation in your tests.

Always include risk management and position sizing in your tests.

Finally, even after making sure of the above, stay careful and monitor the strategy because market dynamics may shift and make the strategy unprofitable.

For the PDF alternative, the price of the book is 9.99 EUR. Please include your email in the note before paying so that you receive it on the right address. Also, once you receive it, make sure to download it through google drive.

Pay Kaabar using PayPal.Me

If you accept cookies, we’ll use them to improve and customize your experience and enable our partners to show you…www.paypal.com