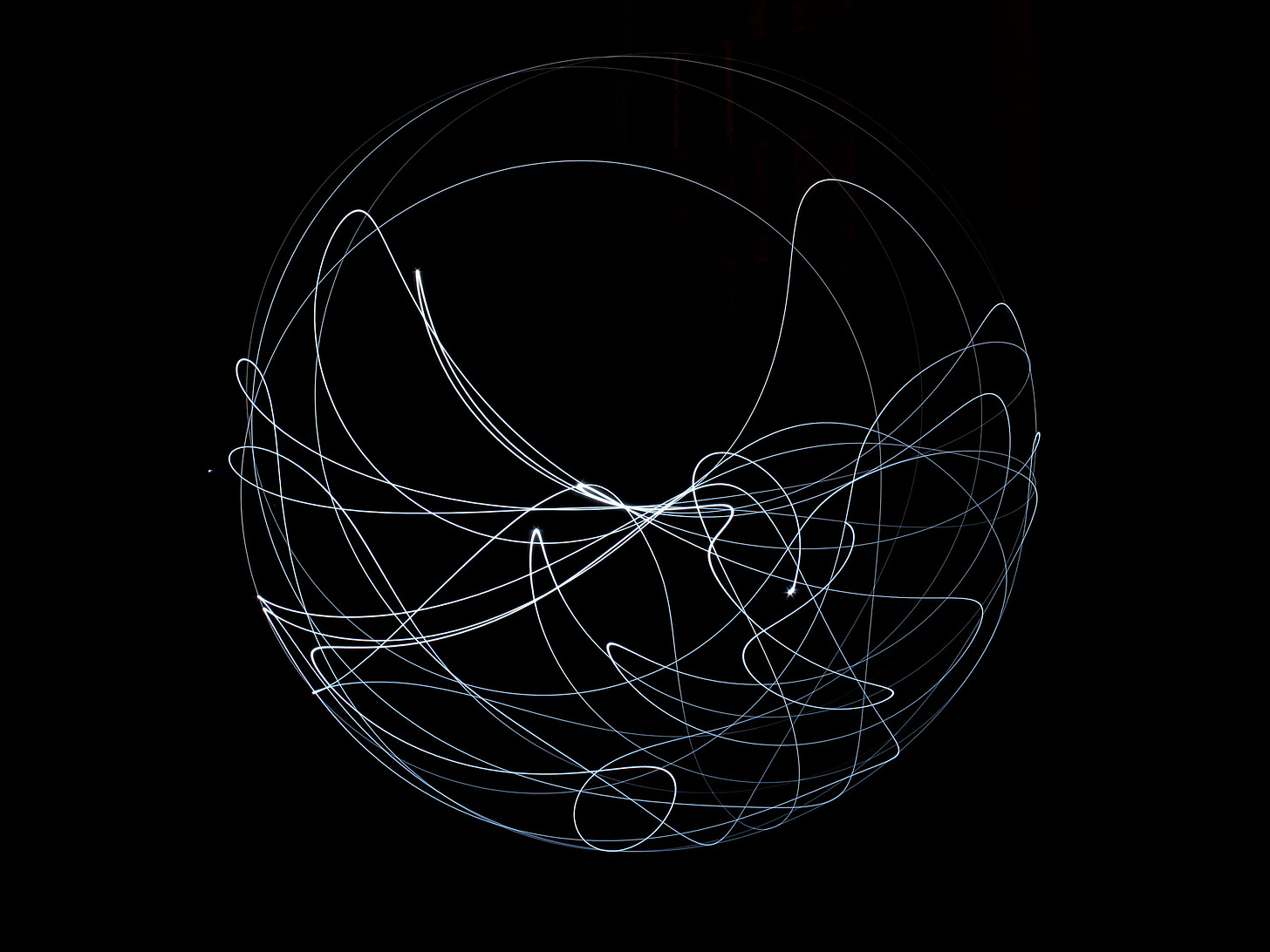

The Fractal Indicator — Detecting Tops & Bottoms in Markets

Insights from Chaos Theory Applied to Trading

The efficient market hypothesis fails to account for the many anomalies and recurring exploitable patterns within financial assets. This is why active portfolio management is still the dominant party when compared to passive investing.

Financial markets are not perfectly random, they are random-like, i.e. they exhibit a low signal-to-noise ratio. In othe…

Keep reading with a 7-day free trial

Subscribe to All About Trading! to keep reading this post and get 7 days of free access to the full post archives.