The Big Mac Index — Forecasting Exchange Rates

Discussing the Big Mac Index and Downloading its Data Using Python

Inflation is measured through many ways such as the consumer price index and the personal consumption expenditure. However, there is an index that has been calculated on a regular basis which seems to track inflation all around the world and as you may have guessed from the bright cover photo that makes your eyes hurt, it compares it to the price of a big mac, this index is called the Big Mac Index.

For a detailed and thorough collection of contrarian trading strategies, you can check out my book. The book features a huge number of classic and modern techniques as it dwelves into the realm of technical analysis with different trading strategies. The book comes with its own GitHub.

Contrarian Trading Strategies in Python

Amazon.com: Contrarian Trading Strategies in Python: 9798434008075: Kaabar, Sofien: Booksamzn.to

Introduction to the Big Mac Index

The Big Mac Index is a non-official quasi-economic indicator published by the Economist that calculates the purchasing power parity (PPP) between two currencies. It is determined by comparing the costs of Big Mac hamburgers that McDonald’s sells in various nations.

According to the Big Mac Index, after accounting for exchange rates, a Big Mac should be around the same price everywhere (this is of course a flaw but we’ll consider it true for simplicity reasons). If a Big Mac costs more in one nation than it does in another, then the value of that country’s currency in relation to the other currency is overvalued.

The Big Mac Index, which was initially presented in The Economist magazine in 1986, has since gained popularity as a straightforward and approachable way to convey the notion of PPP and exchange rate changes. It should be understood, nevertheless, that the index is not an exact representation of PPP and has flaws, such as the fact that it does not take into account regional variables that might affect the cost of a Big Mac.

But what is PPP? The Purchasing Power Parity (PPP) method is an approach for forecasting exchange rates between two currencies. It is based on the idea that over time, the exchange rate between two currencies will adjust such that the purchasing power of each currency is equal in both countries thus making it part of fundamental analysis.

To use the PPP method for forecasting exchange rates, you need to gather data on the prices of a basket of goods and services in both countries (in our case, the Big Mac Index is used as a representative of the basket of goods).

The PPP rate can then be used to forecast future exchange rates by assuming that the PPP rate will continue to hold in the future.

So, to sum up, the PPP is the exchange rate that would make the price of a basket of goods (in this case, a Big Mac hamburger) equal in two different countries.

Visualizing the Big Mac Index

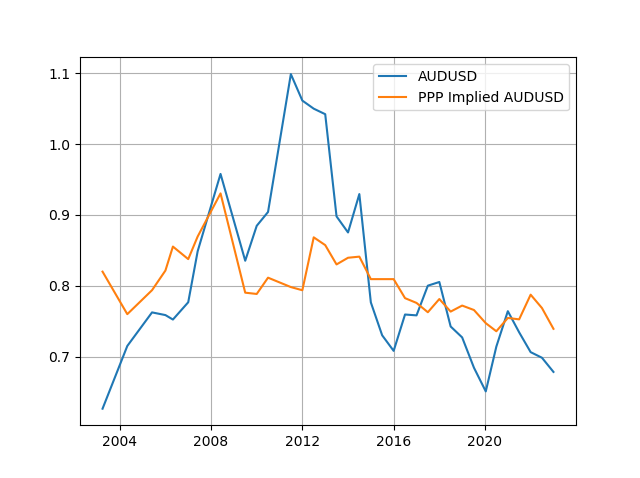

Historical data of the Big Mac Index can be found on The Economist website. The Big Mac Index has been published annually by The Economist since 1986, and the website provides a historical database of the index values dating back to 1986. I have gathered data on the prices of the USA’s and Australia’s big macs for comparison. The historical data is provided in a downloadable Excel or CSV file on the Economist’s GitHub (easy to find online). Let’s see how to use the Big Mac Index to have an understanding of currency valuations:

We’ll divide the price of the price of big mac in one currency by the other which will give us the PPP.

We’ll compare the PPP to the current exchange rate to determine the over or undervaluation.

Here’s an example, the price of a big mac in Australia is around 7.25 AUD while the same burger costs 5.36 USD. The PPP is therefore 0.7390. With a current exchange rate of 0.6785, the AUD seems to be undervalued by around 9% and therefore, the most basic fundamental analysis regardless of other factors states that AUDUSD is bullish with a potential target of 9%.

This is of course far from the truth as one model cannot perfectly forecast currency exchange pairs as a lot more variables must enter the equation. Let’s see how the PPP based on the Big Mac Index was.

In case you want to recreate the above graph, you can download the excel file from my Github here.

import pandas as pd

import matplotlib.pyplot as plt

aud_usd_big_mac = pd.read_excel('AUD_USD_Big_Mac.xlsx')

aud_usd_big_mac['PPP'] = aud_usd_big_mac['USD'] / aud_usd_big_mac['AUD']

plt.plot(aud_usd_big_mac['DATE'], aud_usd_big_mac['AUDUSD'], label = 'AUDUSD')

plt.plot(aud_usd_big_mac['DATE'], aud_usd_big_mac['PPP'], label = 'PPP Implied AUDUSD')

plt.grid()

plt.legend()Obviously, the market deviates from the PPP rate for extended periods of time even though it tends to hover around it.

While the Big Mac Index is a useful tool for comparing the purchasing power of different currencies, it is not a reliable measure of inflation. Inflation is a broad measure of the general increase in the price level of goods and services in an economy over time, whereas the Big Mac Index only looks at the price of a single item — a Big Mac hamburger.

In addition, the prices of Big Macs are influenced by factors other than inflation, such as local food prices, labor costs, and taxes. Therefore, changes in the price of a Big Mac may not always reflect changes in the general price level of an economy.

Furthermore, the Big Mac Index does not account for differences in quality or quantity of goods and services between countries. For example, the cost of healthcare or education can vary significantly between countries, and these differences are not reflected in the Big Mac Index.

Overall, while the Big Mac Index can provide insights into exchange rate movements and the relative purchasing power of different currencies, it is not a suitable tool for measuring inflation. More comprehensive measures, such as the consumer price index (CPI), are better suited for tracking inflation over time.

For a detailed and thorough collection of trend following trading strategies, you can check out my book. The book features a huge number of classic and modern techniques as it dwelves into the realm of technical analysis with different trading strategies. The book comes with its own GitHub.

Trend Following Strategies in Python: How to Use Indicators to Follow the Trend.

Amazon.com: Trend Following Strategies in Python: How to Use Indicators to Follow the Trend.: 9798756939620: Kaabar…amzn.to

Summary

To sum up, what I am trying to do is to simply contribute to the world of objective technical analysis which is promoting more transparent techniques and strategies that need to be back-tested before being implemented. This way, technical analysis will get rid of the bad reputation of being subjective and scientifically unfounded.

I recommend you always follow the the below steps whenever you come across a trading technique or strategy:

Have a critical mindset and get rid of any emotions.

Back-test it using real life simulation and conditions.

If you find potential, try optimizing it and running a forward test.

Always include transaction costs and any slippage simulation in your tests.

Always include risk management and position sizing in your tests.

Finally, even after making sure of the above, stay careful and monitor the strategy because market dynamics may shift and make the strategy unprofitable.