Market gaps, often perceived as abrupt price changes between trading sessions, are common phenomena in financial markets. They represent areas on a chart where no trading activity has taken place, typically resulting from significant news events, earnings reports, or changes in market sentiment.

This article sheds more light on this phenomena and presents a simple trading strategy based on them.

What are Market Gaps?

Gaps occur when the price of a security opens significantly higher or lower than its previous close, resulting in a gap on the price chart. These gaps can be due to various reasons, including after-hours news, earnings reports, or significant market events.

Understanding and identifying these gaps can offer traders unique opportunities to profit. Gaps can occur in various market conditions, each signaling different implications for traders. They are generally classified into four types: common, breakaway, runaway (or continuation), and exhaustion gaps. Our main focus is on common gaps, which are traded through a mean-reversion mecanism (i.e. contrarian). Each type provides distinct insights into market behavior and potential future price movements.

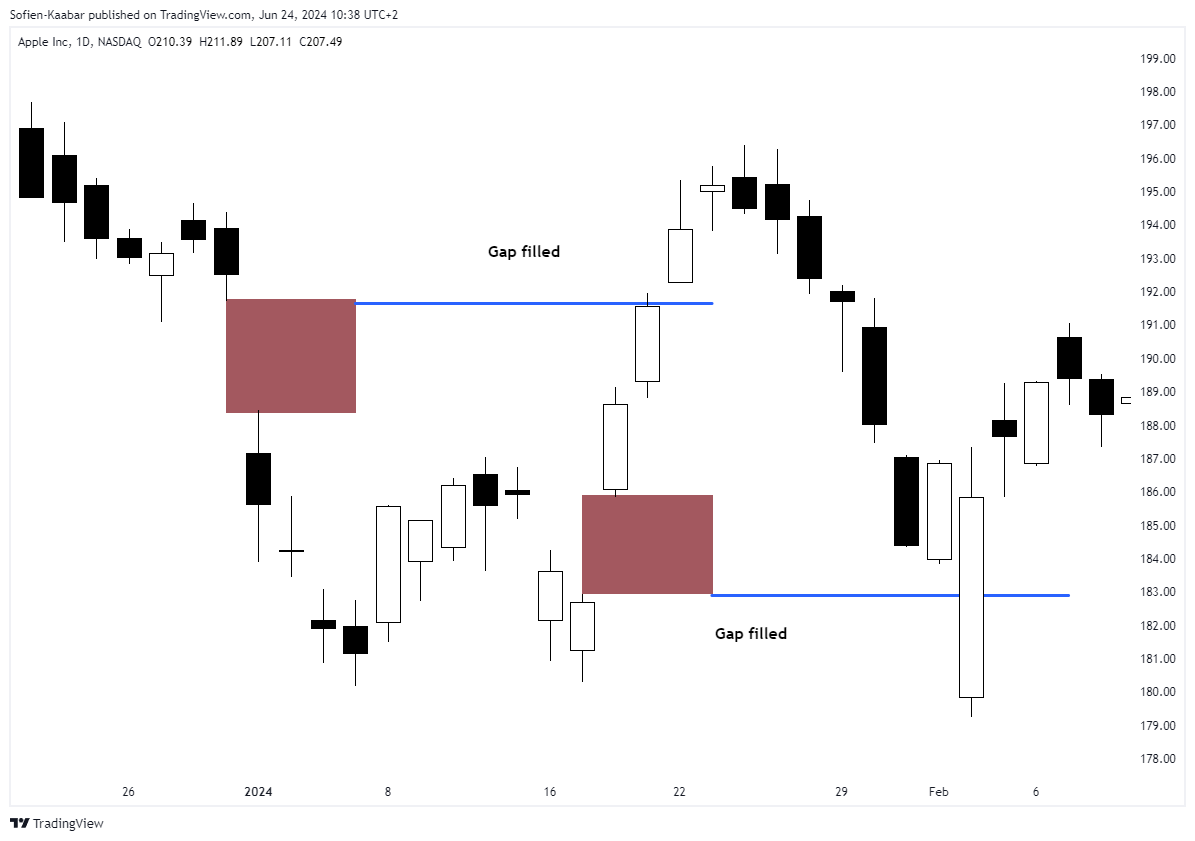

The following chart shows two common gaps getting filled. The process of filling a gap is the core of the common gap characteristics. Here’s how they work:

A gap lower occurs whenever the open price is significantly lower than the previous low price. The trade is bullish and the target is the previous low price (filling the empty space).

A gap higher occurs whenever the open price is significantly higher than the previous high price. The trade is bearish and the target is the previous high price (filling the empty space).

Trading market gaps requires a strategic approach and a keen understanding of the underlying factors that cause them. By employing technical analysis and monitoring market news, you can identify profitable opportunities and mitigate risks.

Let’s Create a Simple Gap Trading Strategy

This strategy is based on the premise that gaps often get filled — meaning the price returns to the pre-gap level. This usually happens because the initial reaction to the news or event that caused the gap might be overdone.

Be careful however, not all gaps get filled. Take a look at the following two gaps:

Notice how the first gap gets filled, but the second one does not. This is why risk management procedures must be taken into account such as a stop-loss.

Using gap trading with technical indicators can unlock a great potential, which we will discuss in further articles.

Gap trading can be a profitable strategy if you understand the types of gaps and the market context in which they occur. It’s crucial to use proper risk management techniques, including setting stop-losses and profit targets, to protect your capital and maximize gains.

As with any trading strategy, it’s recommended to backtest and paper trade these strategies before using real money to ensure they align with your trading style and risk tolerance.

You can also check out my other newsletter The Weekly Market Sentiment Report that sends weekly directional views every weekend to highlight the important trading opportunities using a mix between sentiment analysis (COT report, put-call ratio, etc.) and rules-based technical analysis.

If you liked this article, do not hesitate to like and comment, to further the discussion!

Nice piece!