Simple Machine Learning Models for Time Series - The Tweedie Regression

Machine Learning Models for Time Series Analysis

This article will discuss a machine learning model referred to as Tweedie Regression. We will download a time series from an online source, transform it (i.e. make it stationary) and will simply apply the model’s tools to forecast t+1 values at each time step. We will just apply a simple performance evaluation tool, that is the accuracy (or hit ratio).

Intuition of the Model

The Tweedie Regressor is a type of regression model used when your target variable follows a Tweedie distribution—a flexible family of probability distributions that includes several well-known ones as special cases.

The Tweedie distribution is a compound Poisson-Gamma distribution, and it’s controlled by a parameter called the power parameter (p). Depending on the value of p, you get different distributions:

p = 0 —> Normal

p = 1 —> Poisson

1 < p < 2 —> Compound Poisson-Gamma

p = 2 —> Gamma

p = 3 —> Inverse Gaussian

The range 1 < p < 2 is the most commonly used in insurance and risk modeling, where the target is zero-inflated and positive-continuous (e.g., claim amounts: many zeros, and some large continuous values).

In machine learning (precisely, sklearn.linear_model.TweedieRegressor), the Tweedie Regressor fits a generalized linear model (GLM) assuming the target variable follows a Tweedie distribution.

It has three main inputs:

power– the Tweedie power parameter described above.link– the link function, usually"log"for positive-valued data.alpha– regularization strength.

Do you want to master Deep Learning techniques tailored for time series, trading, and market analysis🔥? My book breaks it all down from basic machine learning to complex multi-period LSTM forecasting while going through concepts such as fractional differentiation and forecasting thresholds. Get your copy here 📖!

Using the Model to Forecast Time Series

Let’s use the model in Python to apply the returns of a time series. We’ll choose the returns of S&P 500 for this task, while knowing that it’s almost impossible to accurately predict such a chaotic dataset with simple models, but we will do it just to make the models work. The plan of attack is as follows:

Download the time series.

Take the returns of the prices to make it stationary (an important condition of machine learning forecasting).

Split the data into training and test sets.

Fit and predict.

Evaluate and plot the predictions.

Use the following code to conduct the experiment.

from sklearn.linear_model import TweedieRegressor

import pandas_datareader as pdr

import numpy as np

import matplotlib.pyplot as plt

def data_preprocessing(data, num_lags, train_test_split):

# Prepare the data for training

x = []

y = []

for i in range(len(data) - num_lags):

x.append(data[i:i + num_lags])

y.append(data[i+ num_lags])

# Convert the data to numpy arrays

x = np.array(x)

y = np.array(y)

# Split the data into training and testing sets

split_index = int(train_test_split * len(x))

x_train = x[:split_index]

y_train = y[:split_index]

x_test = x[split_index:]

y_test = y[split_index:]

return x_train, y_train, x_test, y_test

start_date = '1960-01-01'

end_date = '2020-01-01'

# Import the data

data = (pdr.get_data_fred('SP500', start = start_date, end = end_date).dropna())

data = np.diff(data['SP500'])

# Train-test split

x_train, y_train, x_test, y_test = data_preprocessing(data, 100, 0.80)

# Create and train the model

model = TweedieRegressor()

model.fit(x_train, y_train)

# Make predictions on the test set

y_pred = model.predict(x_test)

# Evaluate the model

same_sign_count = np.sum(np.sign(y_pred) == np.sign(y_test)) / len(y_test) * 100

print('Hit Ratio = ', same_sign_count, '%')

# Plot the actual vs. predicted values

plt.figure(figsize=(12, 6))

plt.plot(y_test[-50:], label = 'Actual', color = 'blue')

plt.plot(y_pred[-50:], label = 'Predicted', color = 'red')

plt.legend()

plt.title('Actual vs. Predicted')

plt.ylabel('Value')

plt.show()

plt.grid()

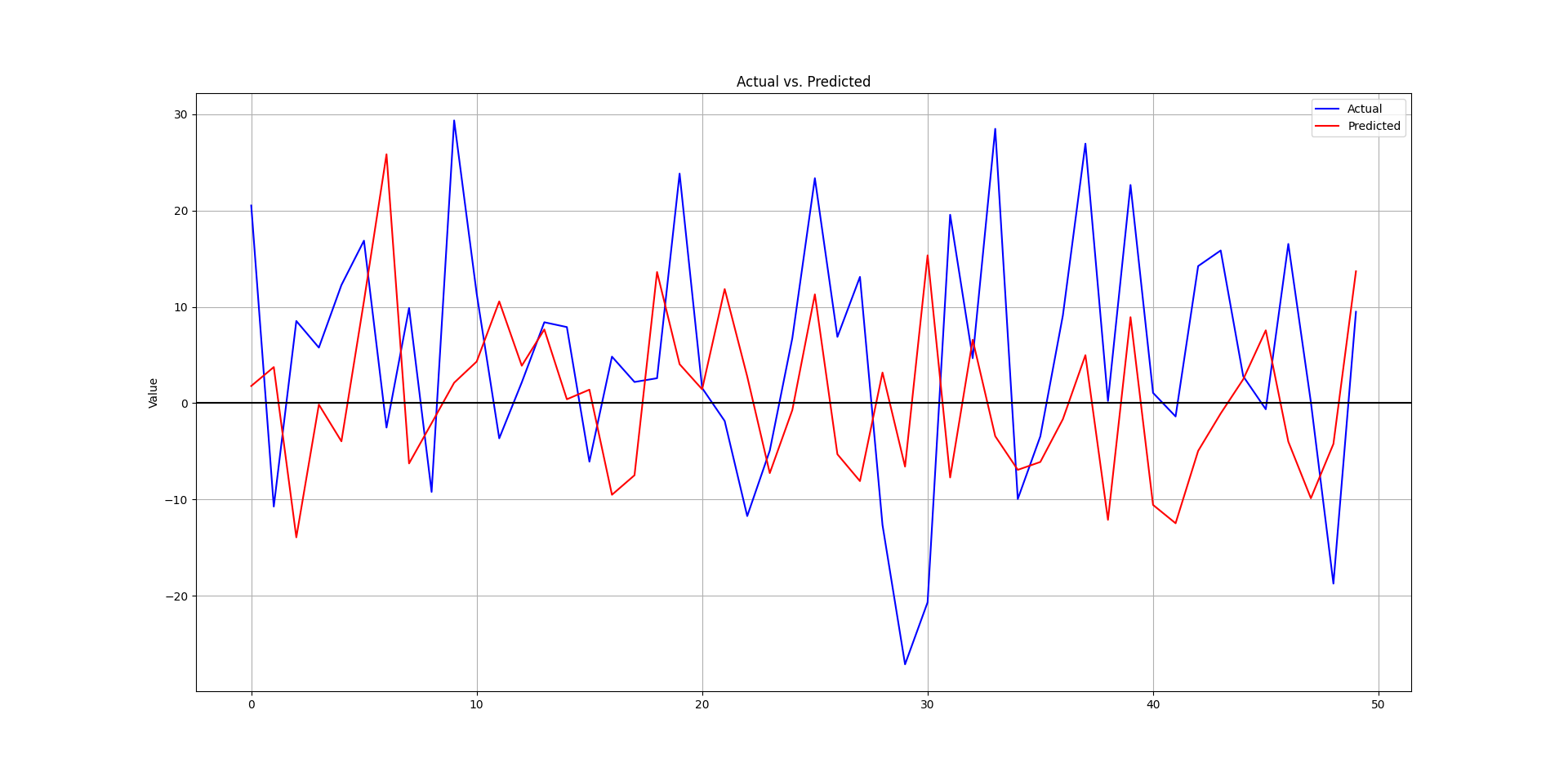

plt.axhline(y = 0, color = 'black')The following is the plot that compares the real data from the test set and the predicted data.

The following output shows the hit ratio.

44.60%Every week, I analyze positioning, sentiment, and market structure. Curious what hedge funds, retail, and smart money are doing each week? Then join hundreds of readers here in the Weekly Market Sentiment Report 📜 and stay ahead of the game through chart forecasts, sentiment analysis, volatility diagnosis, and seasonality charts.

Free trial available🆓