Sentiment Strategies For Equity Trading - The ISM PMI.

Creating a Strategy on the S&P500 Using the ISM PMI in Python.

Sentiment Analysis is a vast and promising field in data analytics and trading. It is a rapidly rising type of analysis that uses the current pulse and market feeling to detect what participants intend to do or what positions they are holding.

Imagine you are planning to go see a movie and you want to anticipate whether this movie will be good or not, therefore, you ask many of your friends — whom have already seen the movie — about their opinions. Assuming 75% said the movie was good, you will have a certain confidence level that you will like it because the sentiment around this movie was mostly good (ignoring tastes and preferences). The same analogy can be applied to the financial markets through many ways either quantitative or qualitative.

Sometimes, indicators will be classified as more than one type, meaning a technical indicator can also be a sentiment indicator (e.g. the On-Balance Volume). And the way we analyze can also be technical (e.g. drawing support and resistance lines) or quantitative (e.g. mean-reversion).

This article will discuss the Institute for Supply Management - Purchasing Manager’s Index and how is it used to analyze the direction of the S&P500. For this study, we will use the signal quality as a judge.

I have just published a new book after the success of my previous one “New Technical Indicators in Python”. It features a more complete description and addition of structured trading strategies with a GitHub page dedicated to the continuously updated code. If you feel that this interests you, feel free to visit the below link, or if you prefer to buy the PDF version, you could contact me on LinkedIn.

The ISM PMI

Sentiment Analysis is a type of predictive analytics that deal with alternative data other than the basic OHLC price structure. It is usually based on subjective polls and scores but can also be based on more quantitative measures such as expected hedges through market strength or weakness.

The Institute for Supply Management provides a monthly survey called the Purchasing Manager’s Index abbreviated to PMI, which is based on questions asked to 400 representatives of industrial companies about the current and future trend of their different activities. It is composed of 5 components that can also be analyzed individually:

New orders — 30% weight.

Production — 25% weight.

Employment — 20% weight.

Supplier Deliveries — 15% weight.

Inventories — 10% weight.

Typically, we interpret the index as 50 being the neutral state of the economy (not growing and neither shrinking). A reading above 50 indicates an expansion in manufacturing and a reading below 50 indicates shrinking in manufacturing. The PMI tends to peak before the whole economy with a lead of 6–12 months, which makes it an astonishing leading indicator (more than 0.70 correlation with the US GDP).

It also tends to lead the stock markets. Historically the values of the PMI fluctuated between 30 and 60, so, they serve as warning signals of possible reversal. The idea of the analysis is to verify this information by creating a strategy that generates directional recommendations on the S&P500 using the idea of mean-reversion.

Downloading the Data & Designing the Strategy

Let us download a sample of both historical data of the ISM PMI and the S&P500 since 1970. I have spared you the grunt work and compiled both into an excel file downloadable from my GitHub below. This way we can import the data directly into the Python interpreter and analyze it.

The first part is to download the ISM_PMI.xlsx data to your computer and then go into the Python interpreter and switch the source to where the excel file is located. Now, we have to import it and structure it.

import pandas as pd

import matplotlib.pyplot as plt

import numpy as np

# Defining Primordial Functions

def adder(Data, times):

for i in range(1, times + 1):

new = np.zeros((len(Data), 1), dtype = float)

Data = np.append(Data, new, axis = 1)

return Data

def deleter(Data, index, times):

for i in range(1, times + 1):

Data = np.delete(Data, index, axis = 1)

return Data

def jump(Data, jump):

Data = Data[jump:, ]

return Data

def indicator_plot_double(Data, first_panel, second_panel, window = 250):

fig, ax = plt.subplots(2, figsize = (10, 5))

ax[0].plot(Data[-window:, first_panel], color = 'black', linewidth = 1)

ax[0].grid()

ax[1].plot(Data[-window:, second_panel], color = 'brown', linewidth = 1)

ax[1].grid()

ax[1].legend()

my_data = pd.read_excel('ISM_PMI.xlsx')

my_data = np.array(my_data)

Now, we should have an array called my_data with both the S&P500’s and the PMI’s historical data since 1970.

Subjectively, we can place a barrier at 40 acting as a support for the economy and a resistance at 60 acting as a break for the economy. These will be our trading triggers for buy and sell signals. Surely, some hindsight bias exists here but the idea is not to formulate a past trading strategy, rather see if the barriers will continue working in the future. Following the intuition, we can have the following trading rules:

Long (Buy) the stock market every time the ISM PMI reaches 40.

Short (Sell) the stock market every time the ISM PMI reaches 60.

def signal(Data, ism_pmi, buy, sell):

Data = adder(Data, 2)

for i in range(len(Data)):

if Data[i, ism_pmi] <= 40 and Data[i - 1, buy] == 0 and Data[i - 2, buy] == 0 and Data[i - 3, buy] == 0 and Data[i - 4, buy] == 0 and Data[i - 5, buy] == 0:

Data[i, buy] = 1 elif Data[i, ism_pmi] >= 60 and Data[i - 1, sell] == 0 and Data[i - 2, sell] == 0 and Data[i - 3, sell] == 0 and Data[i - 4, sell] == 0 and Data[i - 5, sell] == 0:

Data[i, sell] = -1

return DataIf you are also interested by more technical indicators and using Python to create strategies, then my best-selling book on Technical Indicators may interest you:

def signal_chart_ohlc_color(Data, what_bull, window = 1000):

Plottable = Data[-window:, ]

fig, ax = plt.subplots(figsize = (10, 5))

plt.plot(Data[-window:, 1], color = 'black', linewidth = 1) for i in range(len(Plottable)):

if Plottable[i, 2] == 1:

x = i

y = Plottable[i, 1]

ax.annotate(' ', xy = (x, y),

arrowprops = dict(width = 9, headlength = 11, headwidth = 11, facecolor = 'green', color = 'green')) elif Plottable[i, 3] == -1:

x = i

y = Plottable[i, 1]

ax.annotate(' ', xy = (x, y),

arrowprops = dict(width = 9, headlength = -11, headwidth = -11, facecolor = 'red', color = 'red'))

ax.set_facecolor((0.95, 0.95, 0.95))

plt.legend()

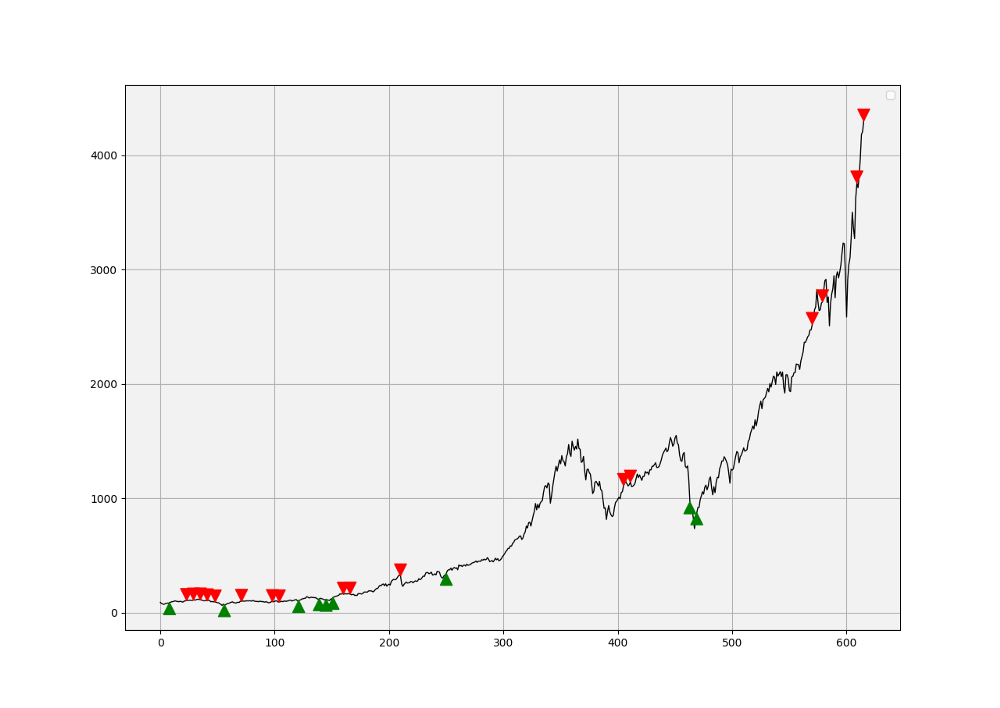

plt.grid()The code above gives us the signals shown in the chart. As a buying-the-dips indicator, the ISM PMI may require some tweaking to improve the signals. Let us evaluate this using one metric for simplicity, the signal quality.

The signal quality is a metric that resembles a fixed holding period strategy. It is simply the reaction of the market after a specified time period following the signal. Generally, when trading, we tend to use a variable period where we open the positions and close out when we get a signal on the other direction or when we get stopped out (either positively or negatively).

Sometimes, we close out at random time periods. Therefore, the signal quality is a very simple measure that assumes a fixed holding period and then checks the market level at that time point to compare it with the entry level. In other words, it measures market timing by checking the reaction of the market.

# Choosing a period

period = 21

def signal_quality(Data, closing, buy, sell, period, where):

Data = adder(Data, 1)

for i in range(len(Data)):

try:

if Data[i, buy] == 1:

Data[i + period, where] = Data[i + period, closing] - Data[i, closing]

if Data[i, sell] == -1:

Data[i + period, where] = Data[i, closing] - Data[i + period, closing]

except IndexError:

pass

return Data

# Using a Window of signal Quality Check

my_data = signal_quality(my_data, 1, 2, 3, period, 4)

positives = my_data[my_data[:, 4] > 0]

negatives = my_data[my_data[:, 4] < 0]

# Calculating Signal Quality

signal_quality = len(positives) / (len(negatives) + len(positives))

print('Signal Quality = ', round(signal_quality * 100, 2), '%')

# Output: Signal Quality = 70.83%A signal quality of 70.83% means that on 100 trades, we tend to see in 71 of the cases a profitable result if we act on it, without taking into account transaction costs. We have had 24 signals based on the conditions provided. For an indicator quoted to be a leader, the results are disappointing especially compared to the other indicators we have seen previously. However, all is not lost. Many optimization techniques can be used to improve the results:

Add a lag factor to the S&P500 so as to see if it delivers value with historical data.

Use another strategy based on the surpass or break of the 50 level.

Change the barriers from 40 and 60 to 35 and 65 and see if it helps.

See if a strategy based on exiting the barrier rather than entering the barrier is better.

Tweak the holding period to determine the optimal reaction window.

Change the conditions of entry and exit by including risk management and entry optimization such as closing out of a position before entering another.

Conclusion

Remember to always do your back-tests. You should always believe that other people are wrong. My indicators and style of trading may work for me but maybe not for you.

I am a firm believer of not spoon-feeding. I have learnt by doing and not by copying. You should get the idea, the function, the intuition, the conditions of the strategy, and then elaborate (an even better) one yourself so that you back-test and improve it before deciding to take it live or to eliminate it.

To sum up, are the strategies I provide realistic? Yes, but only by optimizing the environment (robust algorithm, low costs, honest broker, proper risk management, and order management). Are the strategies provided only for the sole use of trading? No, it is to stimulate brainstorming and getting more trading ideas as we are all sick of hearing about an oversold RSI as a reason to go short or a resistance being surpassed as a reason to go long. I am trying to introduce a new field called Objective Technical Analysis where we use hard data to judge our techniques rather than rely on outdated classical methods.