The COT Report

As mentioned in the introductory post, the COT report shows the positioning of the market with respect to a few underlying assets and currencies. The COT strategies are as follows:

The COT1 strategy uses a normalization technique to detect imminent market shifts while minimizing lag as much as possible.

The COT2 strategy uses a statistical technique to detect sentiment extremes that are bound to reverse.

The COT3 strategy uses a deceleration filter to detect exhaustion in positioning trends.

The COT4 strategy uses a pattern recognition technique to detect imminent reversals in sentiment.

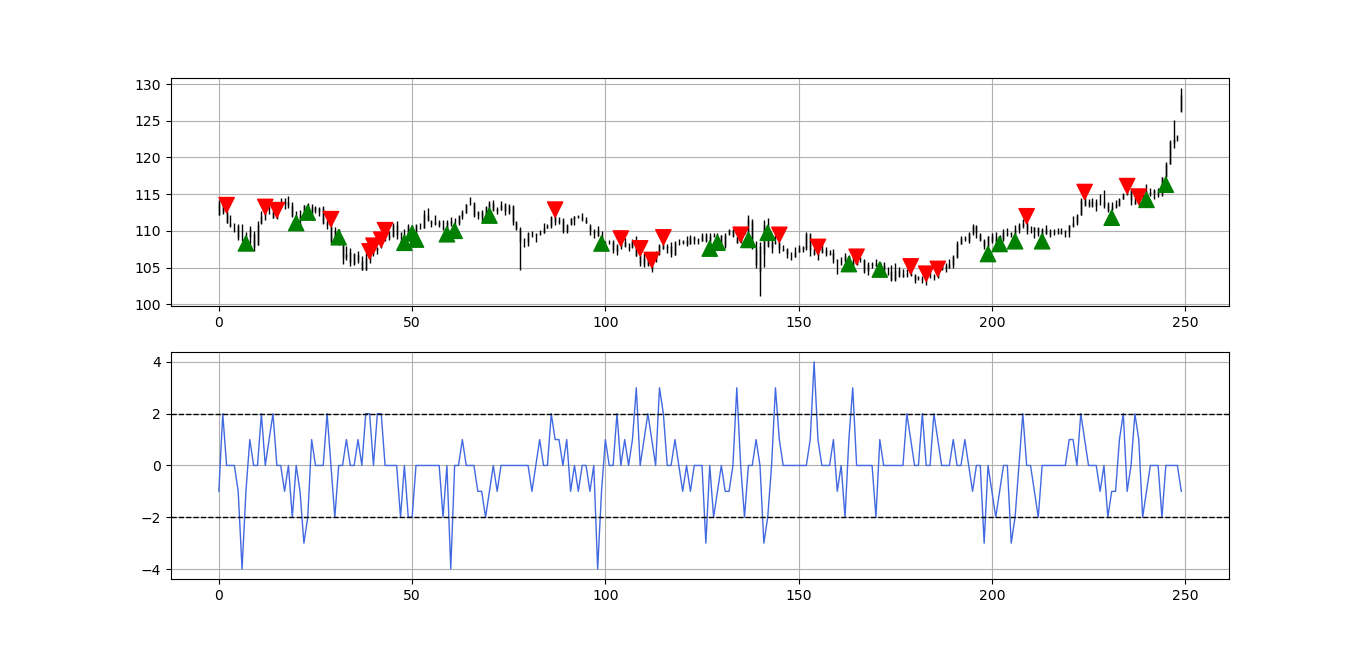

The following Figures show the most recent data with the signals generated by the COT1 strategy. Refer to the commentary below to understand what to expect on every market.

The charts use major proxies versus the USD: EUR is represented by USDEUR, CHF is represented by USDCHF, GBP is represented by USDGBP, JPY is represented by USDJPY, and CAD is represented by USDCAD.

Green arrows point to a bullish sentiment signal while red arrows point to a bearish sentiment signal.

The blue indicator in the second panel is the representation of positioning (and sentiment) with the barriers at 2 and -2.

A cluster of signals enhances the conviction.

USDJPY has more signals in the COT1 strategy than the others because its model is slightly different than the others (which are homogeneous).

It may happen that from time to time, no sentiment signal occurs for a long time.

The following Figures show the most recent data with the signals generated by the COT2 strategy. Refer to the commentary below to understand what to expect on every market.

Sentiment signals must not be used as trade recommendations or investment solicitations.

The past results are not representative of the future results.

Be careful as the chart above is USDGBP and not the more common GBPUSD. This is to harmonize all currency pairs and make the USD the base currency.

The following Figures show the most recent data with the signals generated by the COT3 strategy. Refer to the commentary below to understand what to expect on every market.

The following Figures show the most recent data with the signals generated by the COT4 strategy. Refer to the commentary below to understand what to expect on every market.

Commentary

Globally, there is not a positioning confluence that give a strong idea on a currency pair. However, some minor opportunities may arise.

The signals on USDEUR point to a possible strengthening as shown in COT1 and COT2 strategies.

The signals on USDCHF are mostly neutral at the moment since the last strong bullish trigger. At the moment, none of the four strategies have found an interesting signal.

The signals on USDGBP are mostly neutral at the moment since the last strong bullish trigger, however, The COT3 strategy has had a slightly profitable bearish signal when it expected a consolidation and an exhaustion in the trend.

The signals on USDJPY are mostly neutral as the pair continues its ascent with a strong momentum. No sign of deceleration given by market positioning at the moment. It should be interesting when a bearish signal is triggered. However, a bullish signal can also be triggered as the sentiment indicators are not price-derived.

The signals on USDCAD are mostly neutral and no directional bias in the horizon.