Every analyst, research, strategist, trader, or portfolio manager has a small collection of favorite tools to use when analyzing the markets.

You might be comfortable with certain configuration due to positive results in the past or due to their clear intuition as to what they predict. This article presents my top personal 5 indicators that I constantly monitor.

I have released a new book called “Contrarian Trading Strategies in Python”. It features a lot of advanced contrarian indicators and strategies with a GitHub page dedicated to the continuously updated code. If you are interested, you could buy the PDF version directly through a PayPal payment of 9.99 EUR.

Please include your email in the note before paying so that you receive it on the right address. Also, once you receive it, make sure to download it through google drive.

Pay Kaabar using PayPal.Me

If you accept cookies, we’ll use them to improve and customize your experience and enable our partners to show you…www.paypal.com

5. The SuperTrend Indicator

Type: Trend following.

Overlay: Yes.

The SuperTrend indicator is a trend following overlay technique used to generate signals at the beginning of trends. It is created from a known volatility indicator called the average true range (ATR).

The way to calculate the SuperTrend is complex and I have discussed it in previous articles. For now, I will focus on using the indicator through illustrations.

“The aim is to capture trends at the beginning and to close out when they are over.”

Techniques that can be used with the SuperTrend include the following:

The breakout technique: For a buy signal, whenever the market surpasses the SuperTrend line. For a sell signal, whenever the market breaks the SuperTrend line.

The pull-back: For a buy signal, whenever the market surpasses the SuperTrend line and pulls-back to it. For a sell signal, whenever the market breaks the SuperTrend line and pulls-back to it.

The flat technique: For a buy signal, whenever the market comes back to the SuperTrend flat line from the above. For a sell signal, whenever the market comes back to the SuperTrend flat line from the below.

4. The Relative Strength Index

Type: Contrarian.

Overlay: No.

First introduced by J. Welles Wilder Jr., the RSI is one of the most popular and versatile technical indicators. Mainly used as a contrarian indicator where extreme values signal a reaction that can be exploited. Typically, we use the following steps to calculate the default RSI:

Calculate the change in the closing prices from the previous ones.

Separate the positive net changes from the negative net changes.

Calculate a smoothed moving average on the positive net changes and on the absolute values of the negative net changes.

Divide the smoothed positive changes by the smoothed negative changes. We will refer to this calculation as the Relative Strength — RS.

Apply the normalization formula shown below for every time step to get the RSI.

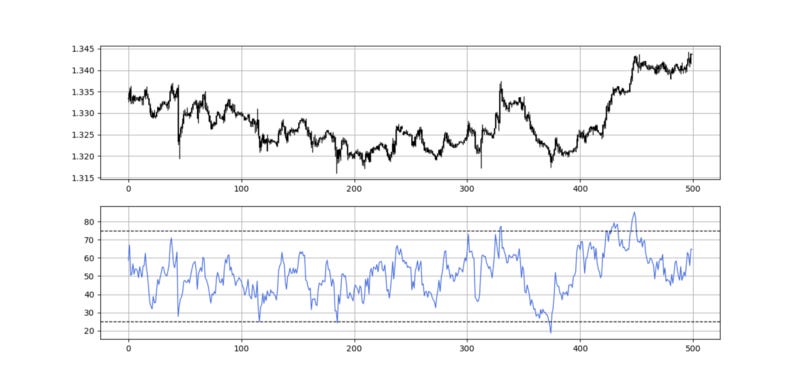

The above chart shows the hourly values of the GBPUSD in black with the 14-period RSI. We can generally note that the RSI tends to bounce close to 25 while it tends to pause around 75. Techniques that can be used with the RSI include the following:

The aggressive technique: For a buy signal, whenever the market touches the lower barrier (generally 30). For a sell signal, whenever the market touches the upper barrier (generally 70).

The conservative technique: For a buy signal, whenever the market surpasses the lower barrier (generally 30). For a sell signal, whenever the market exits the upper barrier (generally 70).

The divergence technique: For a buy signal, whenever the market shapes lower lows while the RSI shapes higher lows. For a sell signal, whenever the market shapes higher highs while the RSI shapes higher lows.

And many more that I discuss in greater depth in other articles.

3. K’s Reversal Indicator

Type: Contrarian.

Overlay: Yes.

This is a combination of two famous indicators and their techniques. I have chosen the mix between the two to deliver an indicator that gives out contrarian signals around the tops and bottoms.

The way to use the indicator is to have a bullish bias whenever a green arrow appears and to have a bearish bias whenever a red arrow appears. I have discussed this indicator and how it is calculated in previous articles.

2. Bollinger Bands

Type: Contrarian.

Overlay: Yes.

Bollinger bands are an envelopment technique that uses standard deviation to find dynamic and support levels. A lot of traders are familiar with this impressive indicator created by John Bollinger. The next Figure shows the EURUSD with the Bollinger bands.

Techniques that can be used with the RSI include the following:

The aggressive technique: For a buy signal, whenever the market touches the lower band (in purple). For a sell signal, whenever the market touches the upper band (in blue).

The conservative technique: For a buy signal, whenever the market surpasses the lower band (in purple). For a sell signal, whenever the market breaks the upper band (in blue).

And many more that I discuss in greater depth in other articles.

1. K’s Fibonacci Moving Average

Type: Trend following.

Overlay: Yes.

Moving averages come in all shapes and types. The most basic type is the simple moving average which is simply the sum divided by the quantity. The next mathematical representation shows how to calculate a simple mean given a dataset:

Therefore, the simple moving average is the sum of the values divided by their number. In technical analysis, you generally use moving averages to understand the underlying trend and to find trading signals.

Check the next Figure which shows a 60-period simple moving average applied on hourly values of Ethereum versus USD.

Assume you have an OHLC data array imported in Python (which I have shown how to do many times in previous articles). The Fibonacci sequence follows this distinct pattern:

The numbers are found by adding the previous two numbers behind them. In the case of 13, it is calculated as 8 + 5, hence the formula is:

Now, from the exponential moving average and the Fibonacci sequence, we will create the Fibonacci moving average which is an equally weighted exponential moving averages using the lookbacks of selected Fibonacci numbers. Here is what I mean step by step:

We calculate exponential moving averages using the following lookbacks {5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987, 1597, 2584, 4181}.

We divide the sum of the exponential moving averages by their number. In our case, we will divide by 15.

Plot the Fibonacci Moving Average alongside the market price.

The way to use the Fibonacci moving average is to assume that its zone forms a dynamic support and resistance levels from where you would expect reactions.

Summary

To sum up, what I am trying to do is to simply contribute to the world of objective technical analysis which is promoting more transparent techniques and strategies that need to be back-tested before being implemented. This way, technical analysis will get rid of the bad reputation of being subjective and scientifically unfounded.

I recommend you always follow the the below steps whenever you come across a trading technique or strategy:

Have a critical mindset and get rid of any emotions.

Back-test it using real life simulation and conditions.

If you find potential, try optimizing it and running a forward test.

Always include transaction costs and any slippage simulation in your tests.

Always include risk management and position sizing in your tests.

Finally, even after making sure of the above, stay careful and monitor the strategy because market dynamics may shift and make the strategy unprofitable.

Good work. Thanks for sharing your favorite indicators!