How to Find Long-Term Support and Resistance Levels

Shape the Beginning of the Trading Year With Important Levels

Price action trading is based purely on price rather than its derivatives such as technical indicators. It enjoys a huge advantage in that it is not lagging. Price is what is happening right now and is either leading or coinciding but never lagging. Price action is all about detecting patterns and finding support and resistance levels.

If you are interested by trend following indicators and strategies then my book could interest you. It features advanced trend-following indicators and strategies with a GitHub page dedicated to the continuously updated code. Also, this book features the original colors after having optimized for printing costs. If you feel that this interests you, feel free to visit the below Amazon link, or if you prefer to buy the PDF version, you could contact me on LinkedIn.

Trend Following Strategies in Python: How to Use Indicators to Follow the Trend.

Amazon.com: Trend Following Strategies in Python: How to Use Indicators to Follow the Trend.: 9798756939620: Kaabar…www.amazon.com

The Concept of Support & Resistance Levels

At its simplest form, a support level is an area supposed to keep prices from going down further. Naturally, when the market price approaches a support area, the right decision is to have a bullish bias.

A resistance level is an area supposed to keep prices from going up further. Naturally, when the market price approaches a resistance area, the right decision is to have a bearish bias.

There are many objective ways of finding support and resistance levels. The aim of this article is twofold:

Show how to generate objective support and resistance levels that are backed by a huge community of traders.

Use the generated support and resistance levels the right way and in the right frame.

Generating Objective Support & Resistance Levels

Pivot points are calculations used to find implied support and resistance levels. They are very simple and very easy to use.

Traders may calculate the levels on a monthly and on a yearly basis. For example, on the first day of January, a trader might calculate the projected support and resistance levels, then every month, he calculates the tactical support and resistance levels. Therefore, the framework becomes as follows:

Find the key support and resistance levels for the year using a mathematical formula relying on the previous year’s data.

Find short-term support and resistance levels for each month to play tactical moves using the previous month’s data.

To calculate pivot point levels, use the below formula:

Let’s take an example on USDCHF. Suppose, you want to find out this year’s key levels and April’s levels for more short-term trading. You have the following data:

2021’s high = 0.9475

2021’s low = 0.8756

2021’s close = 0.9127

March 2022’s high = 0.9462

March 2022’s low = 0.9148

March 2022’s close = 0.9225

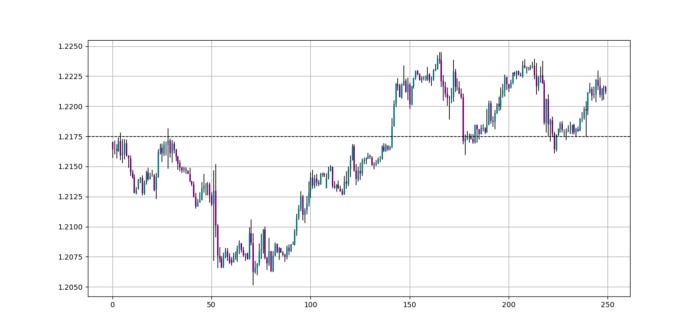

You use the previous formulas and chart them. The following illustration shows a Daily graph of USDCHF showing the levels.

In blue, the key levels of the year calculated as shown previously while the red levels are the key monthly support and resistance levels calculated using March’s data. Note that 2022 starts at the end of the grey zone shown in the chart.

It can be seen that a form of preliminary reaction has already been seen close to the yearly resistance (in blue).

If you want to see how to create all sorts of algorithms yourself, feel free to check out Lumiwealth. From algorithmic trading to blockchain and machine learning, they have hands-on detailed courses that I highly recommend.

Learn Algorithmic Trading with Python Lumiwealth

Learn how to create your own trading algorithms for stocks, options, crypto and more from the experts at Lumiwealth. Click to learn more

Summary

To sum up, what I am trying to do is to simply contribute to the world of objective technical analysis which is promoting more transparent techniques and strategies that need to be back-tested before being implemented. This way, technical analysis will get rid of the bad reputation of being subjective and scientifically unfounded.

I recommend you always follow the the below steps whenever you come across a trading technique or strategy:

Have a critical mindset and get rid of any emotions.

Back-test it using real life simulation and conditions.

If you find potential, try optimizing it and running a forward test.

Always include transaction costs and any slippage simulation in your tests.

Always include risk management and position sizing in your tests.

Finally, even after making sure of the above, stay careful and monitor the strategy because market dynamics may shift and make the strategy unprofitable.