Follow Smart Money to Find High-Flying Stocks in 10 Minutes

Analyze a stock chart, then look at the fundamentals

Hello everyone! Today’s article is brought to you by a brilliant writer in the world of investing, Denis Gorbunov.

Denis knows how to get you hooked on very interesting financial knowledge and planning. If you like his article, make sure to follow his newsletter here:

Here’s a problem most investors face.

They spend hours doing deep dives into 5-10 public companies and select one or two to invest in. But there are 5,000+ stocks traded on the US exchanges.

You can’t dive deeply into every one of them. It’s easy to miss a rising star nobody knows about.

I’ll show you a different way of finding companies with growth potential. And the best news is you only need ten minutes to spot a potential multibagger.

Lesson learned from my pandemic losses

The stock market humbled me during the 2020 Covid crash.

I was holding dividend stocks that tanked and didn’t come back. While the market was booming with Amazon and Zoom hitting new all-time highs, I was holding those underdogs without a clue of what I was doing wrong.

That made me think out of the box. My solution was to build professional relationships with people who trade stocks for a living. I paid them to teach me to trade.

How they see the stock market is a total mindf*ck for someone who follows chat rooms like SeekingAlpha.

Retail investors speak about popular stocks that have already soared. It’s late.

Pro traders look for bargains, and bargains are the companies nobody knows about or believes in. That’s the best time to enter a position provided that there’s growth ahead.

I’ve never become a trader because trading was taking too much of my time (I have a regular 9 to 5). But the framework I learned from my teachers is the best approach to long-term investing I know.

The market participant group you should follow

The process is simple: First you find stock charts that show strength and then you do fundamental analysis.

Humans are visual creatures. It takes you less time to scan a chart than to study a pages long financial statement.

All information about the underlying company is in its stock chart. You should be able to see something in it that the average person doesn’t see.

Whether a chart looks strong or weak comes from who controls the price. There are several market participant groups like retail and professional traders, wealthy families, pension funds, and institutional investors.

Being able to find the activity of the last group is crucial.

Institutional investors are the largest asset management companies like BlackRock and Vanguard. Together they have tens of trillions of dollars under control. It’s the money that the American middle class invests in the financial products they develop (like ETFs).

More than half of those funds are for retirement. Imagine what will happen if the stock market collapses and doesn’t recover (the US will turn into a poor country).

So the institutional investors take their fiduciary duties seriously.

They don’t gamble.

They never buy in euphoria or sell in panic.

They’re long-term investors whose financial activity is an important pillar of the American economy.

The challenge is to uncover their activity. Institutional investors don’t exactly scream at every corner which stocks they’re buying and selling.

Smart money flows slowly

Here’s your edge in the stock market.

Institutional investors don’t accumulate stocks at random prices. They buy them within specific price windows, not higher and not lower. The price windows can be seen in the charts.

The goal is to accumulate millions of shares unnoticed. The institutions buy them slowly over several months without disturbing the price.

So how do you find institutional activity? Follow these steps.

Use a charting software like TradingView (it’s free). Type in the ticker of your target stock and look for a tight sideways trend that lasts several weeks to several months. This is not yet definite proof of institutional activity.

Go to www.nasdaq.com, type in the stock ticker, and click Institutional Holdings. The institutions submit the reports of their buys and sells from the last quarter. It’s public information and it’s delayed by a few weeks. But it’s still sufficient for long-term investing. Match their reporting period with the sideways trend in the stock chart.

If www.nasdaq.com confirms what you see in the stock chart, you know that smart money is interested in the stock. Now is the time to do fundamental analysis. Make sure you understand the industry and the competitive edge of your target company, in addition to

Growing revenues

Improving earnings

Improving cash flows

Stable or falling debt

Etc.

You may click Financials on www.nasdaq.com and get a summary of the company’s financials over the past four quarters or the past four years.

All this won’t take you more than 10 minutes.

Pattern recognition may not come to you on the first day. But take your time. Practice. You’ll soon begin to see tight sideways trends in the stocks of young companies.

Example:

Cloudflare (ticker NET) is a rising cybersecurity star. It helps websites stay fast and secure. 36% of the Fortune 500 companies are its paying clients. Moreover,

Revenue up 29% YoY

Long-term debt $1,3 billion

Free cash flow $167 million

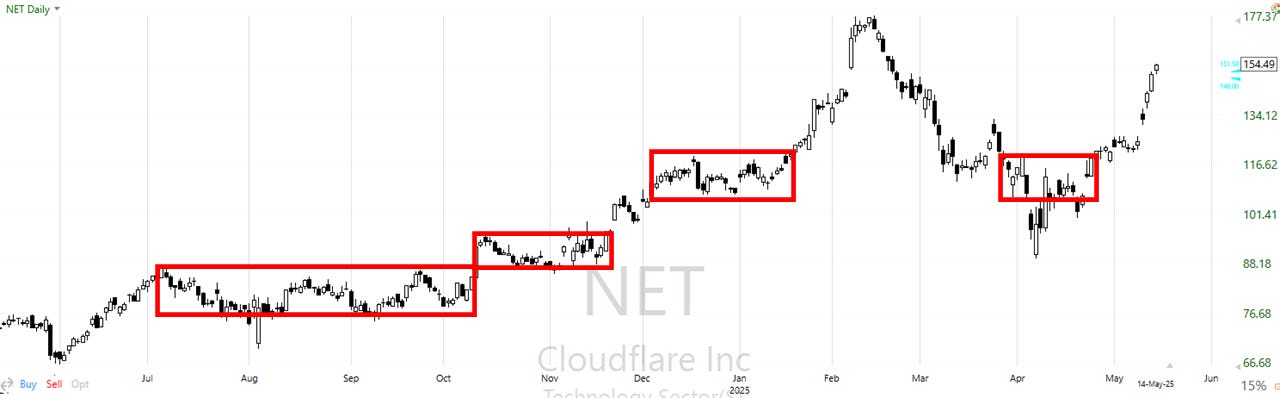

I wouldn’t know any of this if I didn’t see the strong NET stock chart. There’s a truckload of institutional activity. The red rectangles are buy zones.

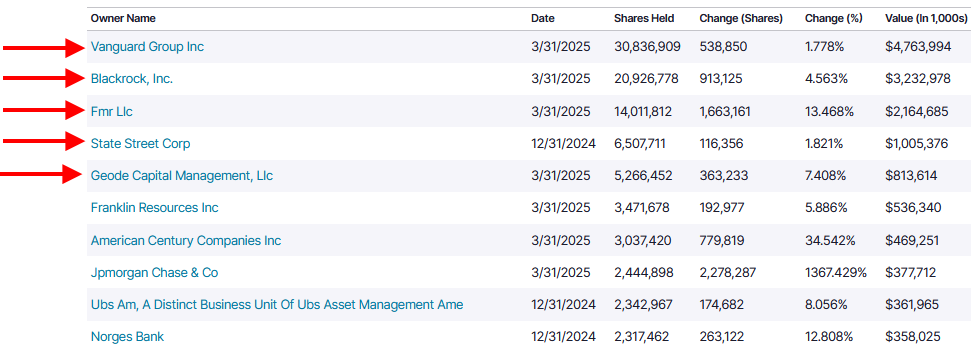

We want to confirm what we see by going to www.nasdaq.com.

There are adjustments of institutional holdings by a few percent every quarter. That doesn’t mean much. But adding or dumping more than 5-7% is worth looking into.

Banks are *not* institutional investors. They’re not allowed to hold stock long-term. Bank trade stocks so don’t try to figure out what they do. Ignore them on www.nasdaq.com.

Pay attention to BlackRock, Vanguard, State Street, Ameriprise, Geode, Fmr, Invesco, and Price T Rowe.

Slow institutional accumulation usually precedes unexpected price run-ups. For you, they won’t be so unexpected if you know what’s behind the sideways trend.

Note how NET stock soared in February, sold off, and came back to the previous buy zone, only to soar again. This is why investing with smart money is low risk.

A word of warning

The charts of popular stocks look messy. It’s hard to find buy zones because the buying and selling activity of the retail crowd is messy. Emotions dominate their investing decisions.

This is the Boeing stock chart. There was institutional accumulation in October 2024 - January 2025. But it’s harder to see a sideways trend.

Stay away from the charts that are difficult to understand. It’s easier to find a stock with growth potential nobody knows about yet. And it will make you more money.

The bottom line

This framework is not a 100% guarantee you’ll find big winning stocks.

Nothing is guaranteed in the stock market. There’s an occasional President flexing his muscles, occasional panic selling, and normal short- to intermediate-term corrections.

Some of your stocks may fall but if you keep a long-term horizon, they should do well. Following smart money gives you more certainty in picking solid companies.

Always check institutional activity around your stocks.

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.