An Interesting Graphical Pattern Trading Strategy

Presenting a Trading Strategy that Relies on Patterns and Graphical Analysis

Pattern recognition is an exciting field where we extract insights from data that repeats itself and shows on average similar outcomes. The challenge is finding these patterns and validating their potential. This article presents a rare but very powerful pattern in a modified way and combined with graphical analysis in a trading strategy.

It is important to understand that this is just an example of a trading strategy aimed to stimulate better and more optimized strategies.

The Extreme Euphoria H/L Pattern

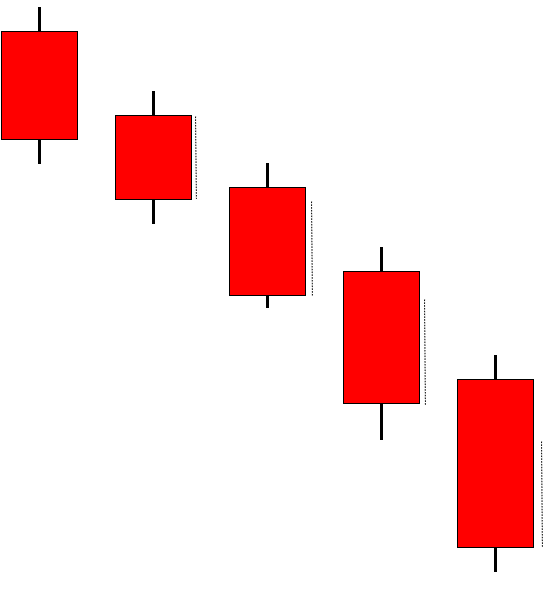

Candlestick charts are among the most famous ways to analyze the time series visually. They contain more information than a simple line chart and have more visual interpretability than bar charts.

The Extreme Euphoria H/L pattern is a modification on the Extreme Euphoria pattern discussed in previous articles. The general shape of the Extreme Euphoria pattern is five candlesticks with the same color and having increasing body ranges with the exception of the second candlestick where it is only preferable to have a bigger body range.

This is because the frequency of signals is greatly reduced if the conditions were strict (even though, theoretically, the conditions are strict but in real life).

The bullish Extreme Euphoria H/L is composed of five bearish candlesticks with each candlestick having a body range (difference between close and open) bigger than the previous one except for the second one where it is only preferable. The main condition is that every low is lower than the previous low. The following Figure shows a theoretical illustration of the bullish Extreme Euphoria.

The bearish Extreme Euphoria H/L is composed of five bullish candlesticks with each candlestick having a body range (difference between close and open) bigger than the previous one except for the second one where it is only preferable. The main condition is that every high is higher than the previous high. The following Figure shows a theoretical illustration of the bearish Extreme Euphoria.

If you want to see more of my work, you can visit my website for the books catalogue by simply following this link:

The Strategy’s Details

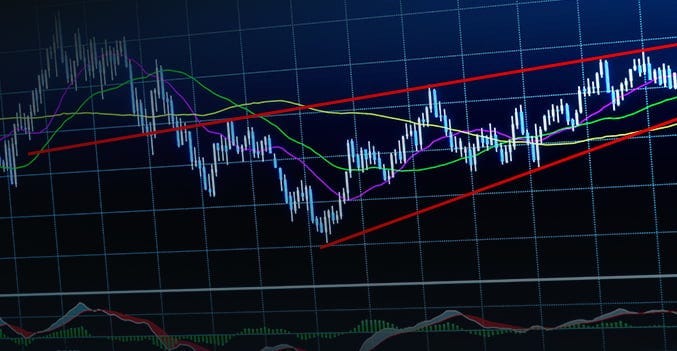

The strategy uses the Extreme Euphoria H/L pattern and combines it with subjective charting analysis. The latter refers to the act of drawing support and resistance lines where there were reactions in the past.

Basic technical analysis teaches us that graphical support and resistance levels are drawn where a maximum number of points have shown at least a few reactions. Take a look at the following signal chart:

It looks like the area of 4375 provides a horizontal support that coincides with a bullish pattern. Combined with an already bullish trend, the trade had a good probability of achieving its target.

The next signal chart shows a descending support from a trend line. Ideally, in a bearish market, we should not be looking to find bullish signals. However, this example shows a happy ending of a bullish reaction following a coincidental reach between the pattern and the support.

The following chart shows another signal on EURUSD. The main disadvantage of the strategy is the rarity of the signals since two conditions must be made with the condition of the pattern being already quite uncommon itself.

Let’s end this with a final example where Nvidia found support around 215 and shaped a less than perfect pattern before moving up.

Naturally, the strategy is not perfect and false signals are bound to occur. Make sure to optimize it to your own terms. One simple example would be to consider long signals in bullish markets and short signals in bearish markets.

You can also check out my other newsletter The Weekly Market Sentiment Report that sends weekly directional views every weekend to highlight the important trading opportunities using a mix between sentiment analysis (COT report, put-call ratio, etc.) and rules-based technical analysis.

If you liked this article, do not hesitate to like and comment, to further the discussion!