Momentum oscillators are numerous and their added-value ranges between very bad to acceptable. It is normal that we will not find something very predictive if we are just applying a lag over the price but we can find insights on the recent behavior of the market price. This article discusses one known oscillator called the Chande Momentum Oscillator.

If you are interested by trend following indicators and strategies then my book could interest you. It features advanced trend-following indicators and strategies with a GitHub page dedicated to the continuously updated code. Also, this book features the original colors after having optimized for printing costs. If you feel that this interests you, feel free to visit the below Amazon link, or if you prefer to buy the PDF version, you could contact me on LinkedIn.

Trend Following Strategies in Python: How to Use Indicators to Follow the Trend.

Amazon.com: Trend Following Strategies in Python: How to Use Indicators to Follow the Trend.: 9798756939620: Kaabar…www.amazon.com

Fetching Historical OHLC Data

Let us start by fetching historical OHLC data before seeing how to code the indicator in Python. One of the most famous trading platforms in the retail community is the MetaTrader5 software. It is a powerful tool that comes with its own programming language and its huge online community support. It also offers the possibility to export its historical short-term and long-term FX data.

The first thing we need to do is to simply download the platform from the official website. Then, after creating the demo account, we are ready to import the library in Python that allows to import the OHLC data from MetaTrader5.

A library is a group of structured functions that can be imported into our Python interpreter from where we can call and use the ones we want.

The easiest way to install the MetaTrader5 library is to go to the Python prompt on our computer and type:

pip install MetaTrader5This should install the library in our local Python. Now, we want to import it to the Python interpreter (such as Pycharm or SPYDER) so that we can use it. Let us actually import all the libraries we will be using for this:

import datetime # Date acquiring

import pytz # Time zone management

import pandas as pd # Mostly for Data frame manipulation

import MetaTrader5 as mt5 # Importing OHLC data

import matplotlib.pyplot as plt # Plotting charts

import numpy as np # Mostly for array manipulationAnything that comes after “as” is a shortcut. The plt shortcut is there so that each time we want to call a function from that library we do not have to type the full matplotlib.pyplot statement.

The official documentation for the Metatrader5 library can be found here.

The first thing we can do is to select which time frame we want to import. Let us suppose that there are only two time frames, the 30-minute and the hourly bars. We can therefore create variables that hold the statement to tell the MetaTrader5 library which time frame we want.

# Choosing the 30-minute time frame

frame_M30 = mt5.TIMEFRAME_M30# Choosing the hourly time frame

frame_H1 = mt5.TIMEFRAME_H1Then, by staying in the spirit of importing variables, we can define the variable that states what date is it now. This helps the algorithm know the stopping date of the import. We can do this by the simple line of code below.

# Defining the variable now to give out the current date

now = datetime.datetime.now()Note that these code snippets are better used chronologically, hence, I encourage you to copy them in order and then execute them one by one so that you understand the evolution of what you are doing. The below is a function that holds which assets we want. Generally, I use 10 or more but for simplicity, let us consider that there are only two currency pairs: EURUSD and USDCHF.

def asset_list(asset_set):

if asset_set == 'FX':

assets = ['EURUSD', 'USDCHF']

return assetsNow, with the key function that gets us the OHLC data. The below establishes a connection to MetaTrader5, applies the current date, and extracts the needed data. Notice the arguments year, month, and day. These will be filled by us to select from when do we want the data to start. Note, I have inputted Europe/Paris as my time zone, you should use your time zone to get more accurate data.

def get_quotes(time_frame, year = 2005, month = 1, day = 1, asset = "EURUSD"):

# Establish connection to MetaTrader 5

if not mt5.initialize():

print("initialize() failed, error code =", mt5.last_error())

quit()

timezone = pytz.timezone("Europe/Paris")

utc_from = datetime.datetime(year, month, day, tzinfo = timezone)

utc_to = datetime.datetime(now.year, now.month, now.day + 1, tzinfo = timezone)

rates = mt5.copy_rates_range(asset, time_frame, utc_from, utc_to)

rates_frame = pd.DataFrame(rates)return rates_frameAnd finally, the last function we will use is the one that uses the below get_quotes function and then cleans the results so that we have a nice array. We have selected data since January 2019 as shown below.

def mass_import(asset, horizon):

if horizon == 'M30':

data = get_quotes(frame_M30, 2019, 1, 1, asset = assets[asset])

data = data.iloc[:, 1:5].values

data = data.round(decimals = 5)return dataFinally, we are done building the blocks necessary to import the data. To import EURUSD OHLC historical data, we simply use the below code line:

# Choosing the horizon

horizon = 'M30'# Creating an array called EURUSD having M30 data since 2019

EURUSD = mass_import(0, horizon)And voila, now we have the EURUSD OHLC data from 2019.

Creating the Chande Momentum Oscillator Step-By-Step

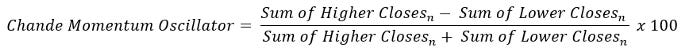

The Chande momentum oscillator is as its name describes it a technical indicator that uses the difference between recent highs and lows divided by their sum in order to gauge the strength of the trend. It is used to measure the relative strength in a market.

If we want to calculate the indicator in Python, we can follow these intuitive steps:

Calculate the sum of the closes that have closed higher during a period.

Calculate the sum of the closes that have closed lower during a period.

Subtract the result of the sum of the lower closes from the sum of the higher closes.

Divide the result from the previous step by the sum of the lower closes and higher closes.

Multiply the result by 100.

In less complicated terms, we will be allocating two columns at first where the first column is populated by the difference between the current closing price and the previous one if the current closing price is higher. The second column is populated by the difference between the current closing price and the previous one if the current closing price is lower.

Next, we can allocate another two columns where the first one will be populated by the sum of the values from the first column using a certain lookback period. The second column will be populated by the absolute sum of the values from the second column using a certain lookback period. Finally, we will allocate one last column which will apply the formula presented above giving us the Chande momentum oscillator.

This is of course not optimal at all code-wise but the aim here is to simplify the steps as much as possible while getting an accurate result.

# The function to add a number of columns inside an array

def adder(Data, times):

for i in range(1, times + 1):

new_col = np.zeros((len(Data), 1), dtype = float)

Data = np.append(Data, new_col, axis = 1)

return Data# The function to delete a number of columns starting from an index

def deleter(Data, index, times):

for i in range(1, times + 1):

Data = np.delete(Data, index, axis = 1)

return Data

# The function to delete a number of rows from the beginning

def jump(Data, jump):

Data = Data[jump:, ]

return Data# Example of adding 3 empty columns to an array

my_ohlc_array = adder(my_ohlc_array, 3)# Example of deleting the 2 columns after the column indexed at 3

my_ohlc_array = deleter(my_ohlc_array, 3, 2)# Example of deleting the first 20 rows

my_ohlc_array = jump(my_ohlc_array, 20)# Remember, OHLC is an abbreviation of Open, High, Low, and Close and it refers to the standard historical data file

def chande_momentum_oscillator(Data, lookback, close, where):

# Adding a few columns

Data = adder(Data, 5)

# Calculating the number of higher closes

for i in range(len(Data)):

if Data[i, close] > Data[i - 1, close]:

Data[i, where] = Data[i, close] - Data[i - 1, close]

# Calculating the number of lower closes

for i in range(len(Data)):

if Data[i, close] < Data[i - 1, close]:

Data[i, where + 1] = abs(Data[i, close] - Data[i - 1, close])

# Calculating the sum of higher closes

for i in range(len(Data)):

Data[i, where + 2] = Data[i - lookback + 1:i + 1, where].sum()

# Calculating the sum of lower closes

for i in range(len(Data)):

Data[i, where + 3] = Data[i - lookback + 1:i + 1, where + 1].sum()

# Calculating the Chande Momentum Oscillator

for i in range(len(Data)):

Data[i, where + 4] = (Data[i, where + 2] - Data[i, where + 3]) / (Data[i, where + 2] + Data[i, where + 3]) * 100

# Cleaning

Data = deleter(Data, 4, 4)

return DataGenerally, the indicator has implied boundaries at 50 and -50 but this can be personalized to each market and according to the current regime. For example, we can follow the trend of a bearish market by lowering the the 50 upper barrier to 40 where we can add to our shorts whenever the market comes back around that area.

Using the Chande Momentum Oscillator

We use the indicator the same way as we use the Relative Strength Index. We establish upper and lower boundaries such as 50/-50 or 65/-65 as shown in the below signal chart on the USDCHF.

A buy (Long) signal is generated whenever the indicator reaches -65 with the previous value above -65.

A sell (Short) signal is generated whenever the indicator reaches 65 with the previous value below 65.

# Indicator Parameters

lookback = 13

upper_barrier = 65

lower_barrier = -65def signal(Data, indicator, buy, sell):Data = adder(Data, 10)

for i in range(len(Data)):

if Data[i, indicator] <= lower_barrier and Data[i - 1, indicator] > lower_barrier:

Data[i, buy] = 1

elif Data[i, indicator] >= upper_barrier and Data[i - 1, indicator] < upper_barrier:

Data[i, sell] = -1

return Datamy_data = chande_momentum_oscillator(my_data, lookback, 3, 4)

my_data = signal(my_data, 4, 6, 7)If you want to see how to create all sorts of algorithms yourself, feel free to check out Lumiwealth. From algorithmic trading to blockchain and machine learning, they have hands-on detailed courses that I highly recommend.

Learn Algorithmic Trading with Python Lumiwealth

Learn how to create your own trading algorithms for stocks, options, crypto and more from the experts at Lumiwealth. Click to learn more

Summary

To sum up, what I am trying to do is to simply contribute to the world of objective technical analysis which is promoting more transparent techniques and strategies that need to be back-tested before being implemented. This way, technical analysis will get rid of the bad reputation of being subjective and scientifically unfounded.

I recommend you always follow the the below steps whenever you come across a trading technique or strategy:

Have a critical mindset and get rid of any emotions.

Back-test it using real life simulation and conditions.

If you find potential, try optimizing it and running a forward test.

Always include transaction costs and any slippage simulation in your tests.

Always include risk management and position sizing in your tests.

Finally, even after making sure of the above, stay careful and monitor the strategy because market dynamics may shift and make the strategy unprofitable.